High-volume OTP delivery: 4 best practices for banking leaders

How Banks Achieve 100%+ OTP Deliverability at Scale: 4 Proven Best Practices

TL;DR

High-volume OTP delivery works best when banks treat it like core notification infrastructure. Building redundancy, using smart routing, tracking messages end-to-end, and testing newer channels helps achieve 100%+ OTP deliverability without increasing costs or engineering effort.

Why high-volume OTP delivery needs a new approach

Digital banking is built on several small, invisible moments of trust. The one-time password (OTP) a customer receives is one such moment. Every OTP is a promise that a transaction, log-in, KYC verification, or account update will proceed safely. Miss that promise even by a few seconds,and it leads to customer frustration, lost revenue, and a stream of support tickets.

At today’s scale, this challenge is constant. Millions of online transactions each day mean millions of OTPs sent daily. When delivery fails, the cost compounds quickly through retries, drop-offs, and operational overhead. As a result, the conversation has shifted from “Do we need better delivery?” to “What precise measures guarantee 100%+ OTP deliverability without ballooning spend or headcount?”

The following four best practices help banking leaders address OTP delivery as a reliability problem, not just a messaging task.

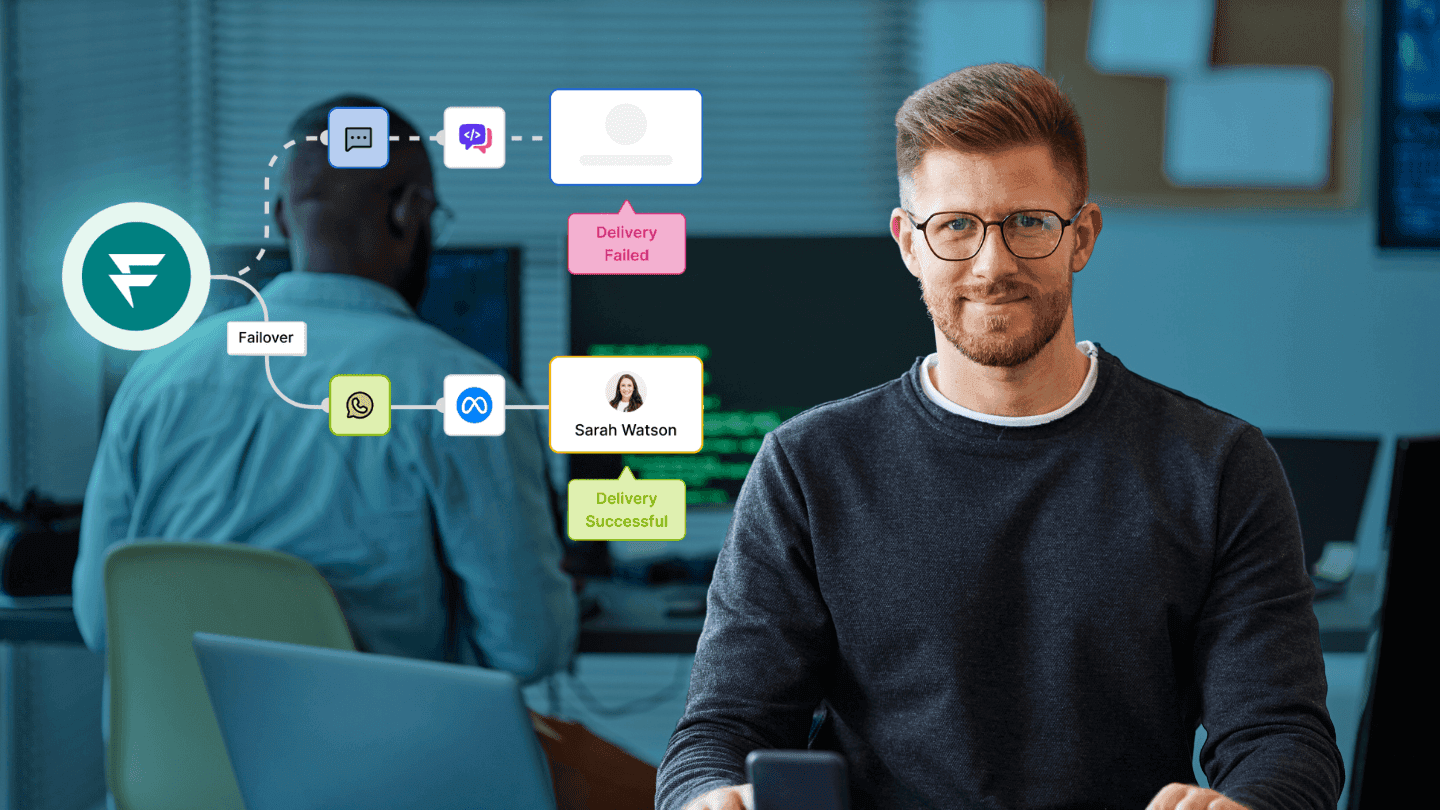

Build redundancy before scale

Relying on a single channel or provider for OTP delivery creates a single point of failure. Banks should work with multiple providers per channel and distribute traffic to maintain consistent performance, even during traffic spikes or partial outages.

Redundancy also requires fast failover. When a provider slows down or fails, traffic must automatically shift to an alternate provider or even an alternate channel within seconds. This prevents delays from becoming visible to customers and protects critical journeys such as logins and payments.

An intelligent communication hub like Fyno makes this practical by allowing teams to configure load distribution, provider priority, and geo-based routing without manual intervention.

Achieve higher deliverability with smart routing

High OTP deliverability depends on making the right routing decision for every message. Instead of static “primary-backup” rules, smart routing evaluates each send attempt using real-time and historical signals.

Effective routing engines consider latency, cost, user channel preferences, geography, and error rates before selecting the optimal vendor or channel. This approach reduces retries, improves first-attempt success rates, and helps control messaging costs.

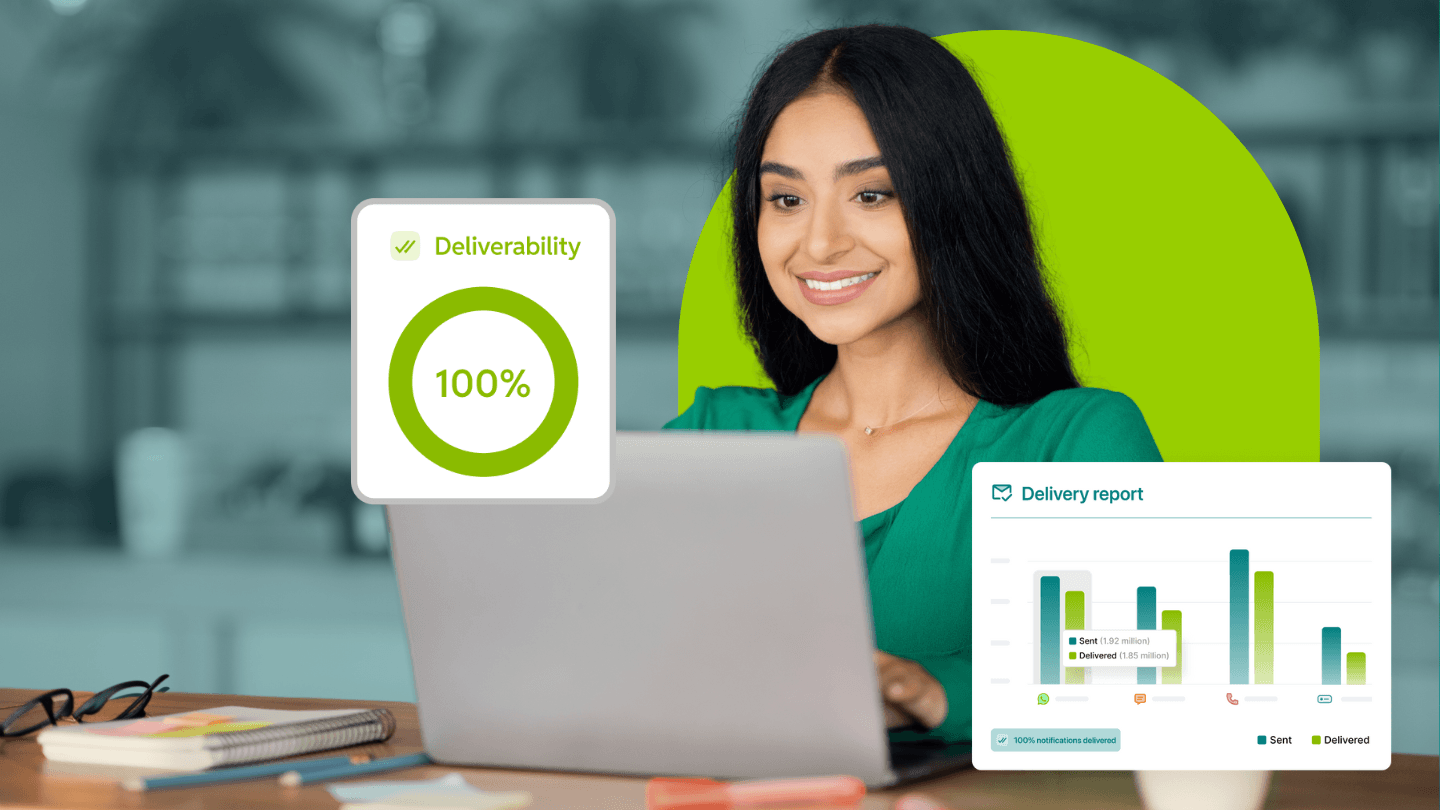

Fyno’s smart routing engine automates this process, continuously adapting to performance changes so teams achieve 100% deliverability for critical communications and don’t have to manage issues manually.

Track every message, from dispatch to delivery

Knowing that an OTP was “sent” is not enough,especially when disputes or regulatory audits arise. Banks need full visibility into what happened after dispatch, including whether the message was delivered, delayed, or failed.

Modern OTP tracking should capture timestamps, provider and operator responses, error codes, and delivery receipts in real time. These detailed audit logs enable faster troubleshooting, support compliance requirements, and provide reliable proof during investigations.

Teams using Fyno gain access to consolidated, real-time logs that give a clear, end-to-end view of OTP delivery across all providers and channels.

Test newer channels to improve deliverability

To reduce dependency on traditional SMS, many banks are experimenting with newer channels such as WhatsApp or time-based OTPs delivered as in-app messages. These channels can improve reliability and customer experience for certain transactions.

The key is flexibility. Banks should be able to test and scale new channels quickly without adding engineering overhead. With Fyno’s no-code workflow builder, teams can add providers, introduce new channels, and adjust delivery flows without writing or maintaining code.

Fyno: 100% delivery is just one of the benefits

Fyno is the intelligent communications hub designed for BFSI to streamline the entire customer communication stack. Its capabilities include:

A single unified communication API

No-code workflow builder

Smart routing with retries and failover

Detailed audit logs

Real-time analytics for cost optimisation

Vendor-wise analytics for reconciliation

Telco operator integrations and DLT approval management

Direct Meta integration, so that banks can go live with whatsapp based journeys faster.

Banks using Fyno report sub-five-second median OTP delivery and upto 30% cost savings, achieved without ongoing development or maintenance effort.

It’s decision time!

OTP volumes have outgrown traditional CPaaS. Reliability, observability, compliance, and cost discipline are now non-negotiable.

Banking leaders should ask their CPaaS or BSP vendors:

Do we have automatic failovers across channels and vendors?

Are we routing OTPs based on performance and cost?

Can we adopt new channels without heavy engineering or are we locked in?

If gaps exist, the solution is clear: introduce an intelligent, compliant, channel & vendor-agnostic orchestration layer like Fyno between core banking systems and communication vendors to achieve 100% OTP delivery.

Summary

OTPs are critical trust moments in digital banking

Redundancy and smart routing prevent delivery failures

End-to-end tracking supports audits and faster resolution

New channels improve resilience

Fyno provides a unified orchestration layer for reliable OTP delivery.

Comments

Your comment has been submitted