Unified templates at scale: maintaining brand voice across channels with CCM

TL;DR

Unified template management enables banks and insurers to maintain consistent brand voice, regulatory compliance, and operational efficiency across channels. By managing templates from a single CCM, teams reduce errors, speed up approvals, and scale customer communication without losing control.

Why brand consistency matters in regulated financial messaging?

Banks and insurers have worked hard to build customer trust, yet the moment a message lands in a customer’s inbox with the wrong tone, a missing logo, or an outdated disclaimer, that trust erodes.

In a sector governed by regulations as detailed as the Reserve Bank of India’s localization and audit-trail rules, consistency is not a branding nicety, but is a compliance requirement.

What breaks when template management is fragmented?

Despite the stakes, many institutions still manage templates in silos. Email, SMS, WhatsApp, and push notifications are often created, edited, and approved in separate vendor portals.

This fragmentation results in:

Inconsistent brand voice across channels

Duplicate edits when regulations or campaigns change

Slower campaign launches

Higher compliance risk due to manual errors

Daily friction between marketing, product, and compliance teams

At scale, fragmented template management turns customer communication into an operational liability.

What is unified template management in a CCM?

Unified template management allows teams to create, edit, approve, and version templates for all communication channels from a single Customer Communication Management (CCM) platform.

Instead of treating each channel independently, teams work from one source of truth. A single update,whether to legal copy, branding, or dynamic variables,can be reflected across email, SMS, WhatsApp, push, and in-app messages. CCM platforms like Fyno are designed around this centralized model.

Why templates are the heart of brand voice

A template is more than a layout. It anchors tone, terminology, typography, colour, dynamic variables and mandatory disclosures. If template governance breaks down, so does brand voice.

Banks face special pressure here because their messages carry monetary consequences. A mismatched interest-rate figure in an SMS could trigger customer complaints; a missing privacy clause in a WhatsApp notification could invite penalties for non-compliance .

A template layer that is centralised, version-controlled and approved directly through DLT and Meta workflows keeps those risks contained.

From five editors to one: how a unified template editor works

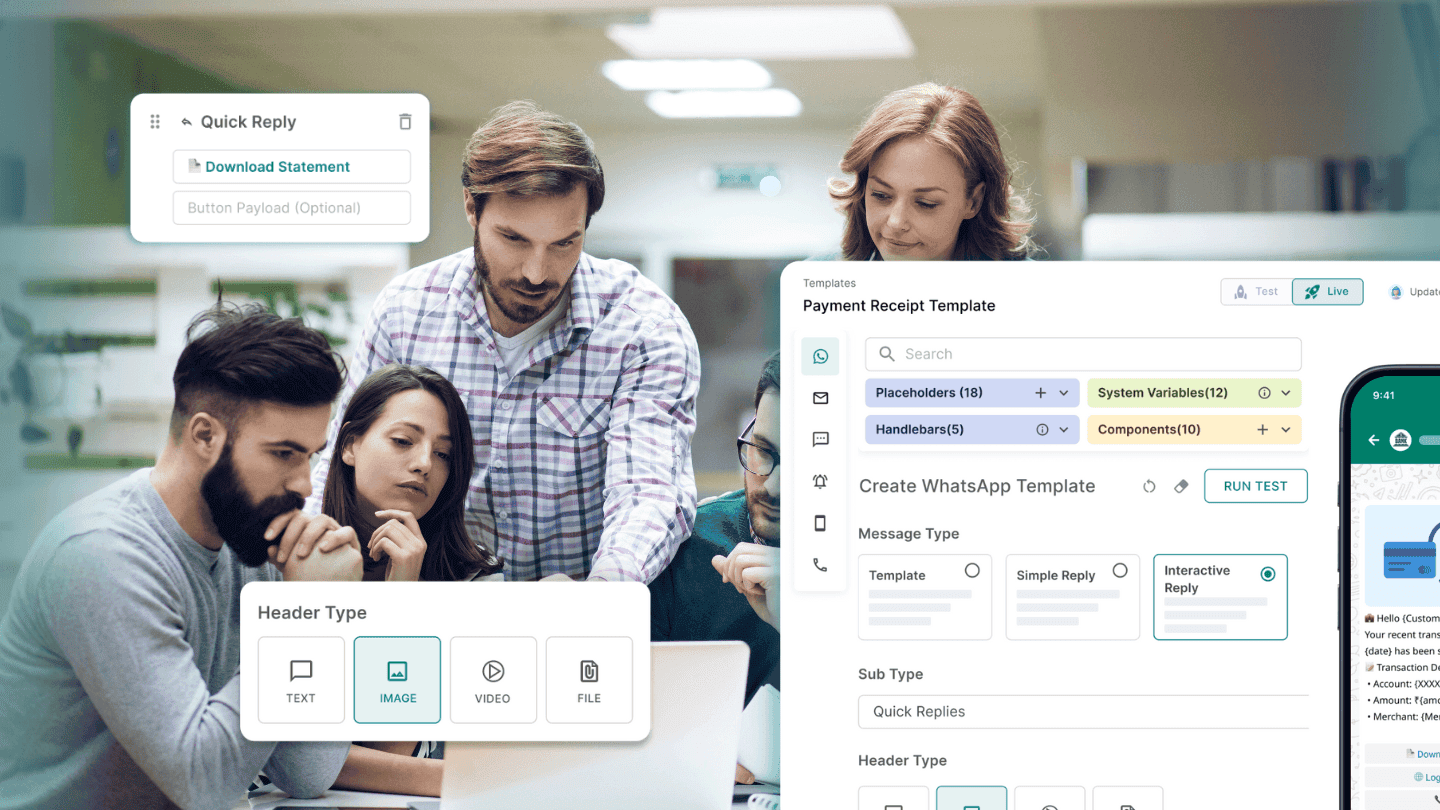

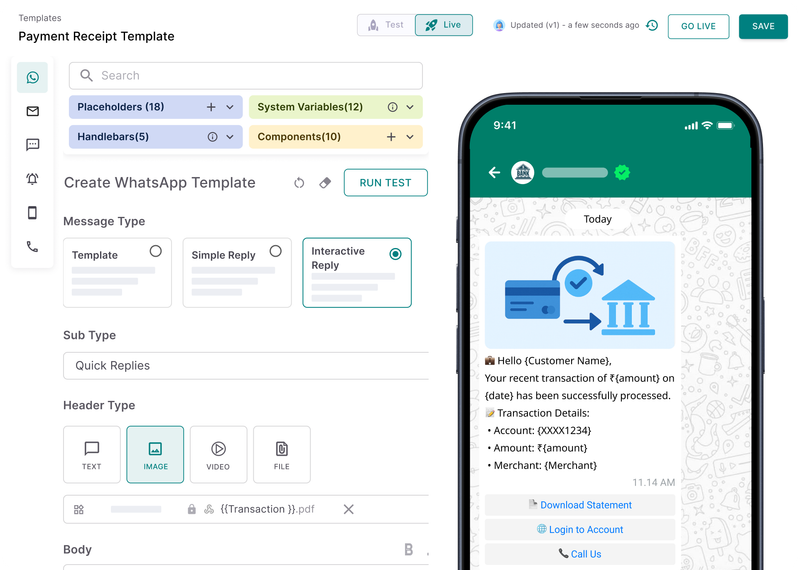

A unified template editor lets teams create channel-specific variants of the same message from one interface. Instead of switching dashboards, teams design once and adapt content for email, SMS, WhatsApp, RCS, push, or in-app delivery.

Modern editors typically support:

Drag-and-drop creation

Multiple languages

Dynamic variables and conditional logic

Channel-specific formatting rules

Fyno's template editor follows this approach, allowing teams to manage all channels without writing code or maintaining multiple tools.

Built-in governance without bottlenecks

Consistency must not come at the expense of security or privacy. CCMs built for regulated environments include governance features such as:

Maker-checker approval flows

Role-based access control

Full audit history with timestamps

Version rollback

Every change,who edited what and when is recorded. Compliance teams gain audit-ready visibility, while marketing and product teams retain the ability to move quickly. FYNO includes these controls as part of its template management layer.

Smart optimization and cost control

Fyno’s template editor comes with a built-in insights engine that notifies you when your SMS length exceeds the ideal number of credit(s). The platform also suggests shorter subject lines or cheaper fallback channels to keep delivery bills in check, and these recommendations appear before a template is published.

For banks sending tens of millions of OTPs and statements each month, such marginal gains quickly translate into noticeable cost savings.

Why do embedded approvals lower regulatory risk?

The traditional roadblock for banks is the external approval cycle. SMS templates must pass DLT checks, while WhatsApp needs Meta sign-off. Submitting, waiting, and then copying the approval ID back into multiple vendor portals can take days. By embedding these gateways inside the CCM, teams submit once and have the resulting IDs synced automatically across suppliers . The reduction in manual re-entry removes a common source of human error that could otherwise expose the bank to TRAI penalties for mismatched template usage .

How can banks get started with unified template management?

Moving to unified template management does not require a full rebuild. Banks can:

Import existing templates into the CCM

Connect Meta and DLT accounts for centralized approvals

Standardize access controls, versioning, and governance

This phased approach reduces fragmentation without disrupting ongoing operations.

.

Conclusion:Why unified templates are now infrastructure

For financial institutions, brand voice, regulatory compliance, and operational efficiency are inseparable. Fragmented template management puts all three at risk.

Unifying templates within a modern CCM turns customer communication into a controlled, scalable system. With one editor, one audit trail, and one approval path, banks and insurers can communicate confidently across channels,without losing consistency or trust.

Comments

Your comment has been submitted