WhatsApp Business Indian Rupee (INR) Direct Billing (2026 Guide)

How Local Currency Pricing Can Save BFSI ₹1-15 Cr in WhatsApp Messaging Costs?

Why This Matters (Summary):

If your bank or financial institution sends 1Mn+ WhatsApp messages monthly, you're likely losing ₹1-15 Cr annually to hidden markup and FX charges buried in CPaaS billing. Meta is set to launch direct INR billing in 2026, and that changes everything. Most enterprises don't realise they're overpaying 12-20% on every conversation. This guide shows BFSI leaders how to eliminate BSP markup (paying Meta's ₹0.86 rate instead of ₹0.96-1.00), gain complete cost transparency by product line and LOB, and forecast 2026 communication budgets with predictable economics. Intelligent communication and orchestration platforms like Fyno enable direct Meta connectivity without replacing your existing infrastructure or sacrificing technical capabilities. It gives you the strategic advantage of treating communication as an optimisable asset rather than an uncontrollable cost center. Read this if you're planning FY 2026-27 budgets and need to demonstrate where ₹15 Cr in annual savings will come from.

How WhatsApp Business INR Billing in 2026 Will Reduce Communication Costs for Indian Enterprises

Your bank sends 50 million WhatsApp messages monthly as OTPs, loan approvals, policy updates, and marketing. Your CPaaS provider bills ₹4.27Cr. But Meta's published rate for these conversations? ₹3.56 Cr. The ₹71 lakhs difference is FX (foreign exchange) markup and reseller economics you're paying for without realising it.

For BFSI enterprises spending ₹15-20 Cr annually on customer communication, hidden markup costs compound into ₹1-15Cr in annual waste. Meta is launching direct INR billing for WhatsApp Business in India and that eliminates FX conversion markups and creates unprecedented cost transparency heading into 2026.

What is WhatsApp Business INR Billing in 2026?

WhatsApp Business INR billing in 2026 is Meta's direct pricing model that allows Indian enterprises to pay for WhatsApp Business API conversations in Indian Rupees instead of US Dollars. This model eliminates foreign exchange conversion markups, enabling organisations to work directly with Meta while maintaining predictable and transparent pricing.

Under INR billing, enterprises pay Meta's published rates directly per marketing conversation without the 12-20% markup traditionally added by CPaaS resellers. This creates immediate cost savings and budget predictability for high-volume WhatsApp users in banking, insurance, and lending sectors.

What are WhatsApp Business Charges in India for 2026?

Meta's billing as of now for WhatsApp Business API is in US Dollars.

Most Indian enterprises pay 12-20% more through CPaaS resellers who add FX conversion markups and platform fees. Under traditional CPaaS models, marketing conversations will cost ₹0.87-0.89 due to combined FX markup (3-4%) and platform markup (12-20% total), even if Meta is charging ₹0.71 per marketing message.

For enterprises sending 50 million marketing messages monthly, this difference equals ₹65 lakh in monthly costs - ₹7.8 Cr annually heading into 2026.

Why Do Traditional CPaaS Platforms Charge More?

CPaaS platforms charge 12-20% above Meta's base rates because their business model requires marking up delivery services. This creates three cost layers:

Meta's base conversation rate in US Dollars ($0.008 for marketing conversations)

FX conversion markup (3-4% above market rates: ₹91.67-92.56/USD vs ₹89/USD)

Platform delivery markup (8-16% additional)

Combined effect: ₹0.87-0.89 per conversation instead of Meta's ₹0.712 direct rate.

Compound Effect at Scale: At 100 million messages monthly:

FX markup alone: ₹2.1-2.8 Cr annually

Platform markup: ₹7-14 Cr annually

Total unnecessary cost: ₹9-17 Cr annually

How Much Can You Save with Direct WhatsApp INR Billing in 2026?

Direct INR billing eliminates both FX conversion markup (3-4%) and platform reseller markup (8-16%), reducing your effective cost per conversation from ₹0.96-1.00 to ₹0.86.

WhatsApp Business Charges Comparison

Budget Predictability Beyond Savings

CPaaS Problem: Festival campaign drives traffic from 50M to 80M messages (60% growth). Base cost increases ₹2.13 Cr, but markup cost compounds by an additional ₹53L, making 2026 budget forecasting impossible.

Once Meta starts billing directly in INR: Same 60% traffic increase = exactly 60% cost increase (₹2.13 Cr). Platform fee scales on features, not message volume. Finance calculates exact ROI: Volume × ₹0.86 = predictable campaign cost. But this is only followed in intelligent orchestration platforms like Fyno.

What is the Difference Between CPaaS and Orchestration Platforms?

CPaaS Platform Model:

Owns Meta relationship, resells API access

Revenue from marking up conversations (12-20%)

Single bundled invoice obscures true costs

Success metric: maximize message volume

Orchestration Platform Model:

Facilitates your direct Meta relationship

Revenue from platform usage (API calls, features)

Separated billing: Meta + technology clearly distinguishable in invoice

Success metric: optimize delivery efficiency and cost

Why Don't Orchestration Platforms Charge Markup?

Orchestration platforms like Fyno don't charge markup on conversations because their core product is technology & notification infrastructure, not communication delivery.

Fyno generates revenue from orchestration capabilities:

Intelligent routing,

Compliance automation,

Unified analytics

rather than reselling Meta's conversations.

Business Model Alignment:

CPaaS: More messages at higher cost = more revenue

Orchestration: Better efficiency with fewer wasted messages = more value

Karnataka Gramin Bank and Lendingkart deploy Fyno’s orchestration platform that aligns with reducing costs and improving delivery outcomes rather than maximizing message volume.

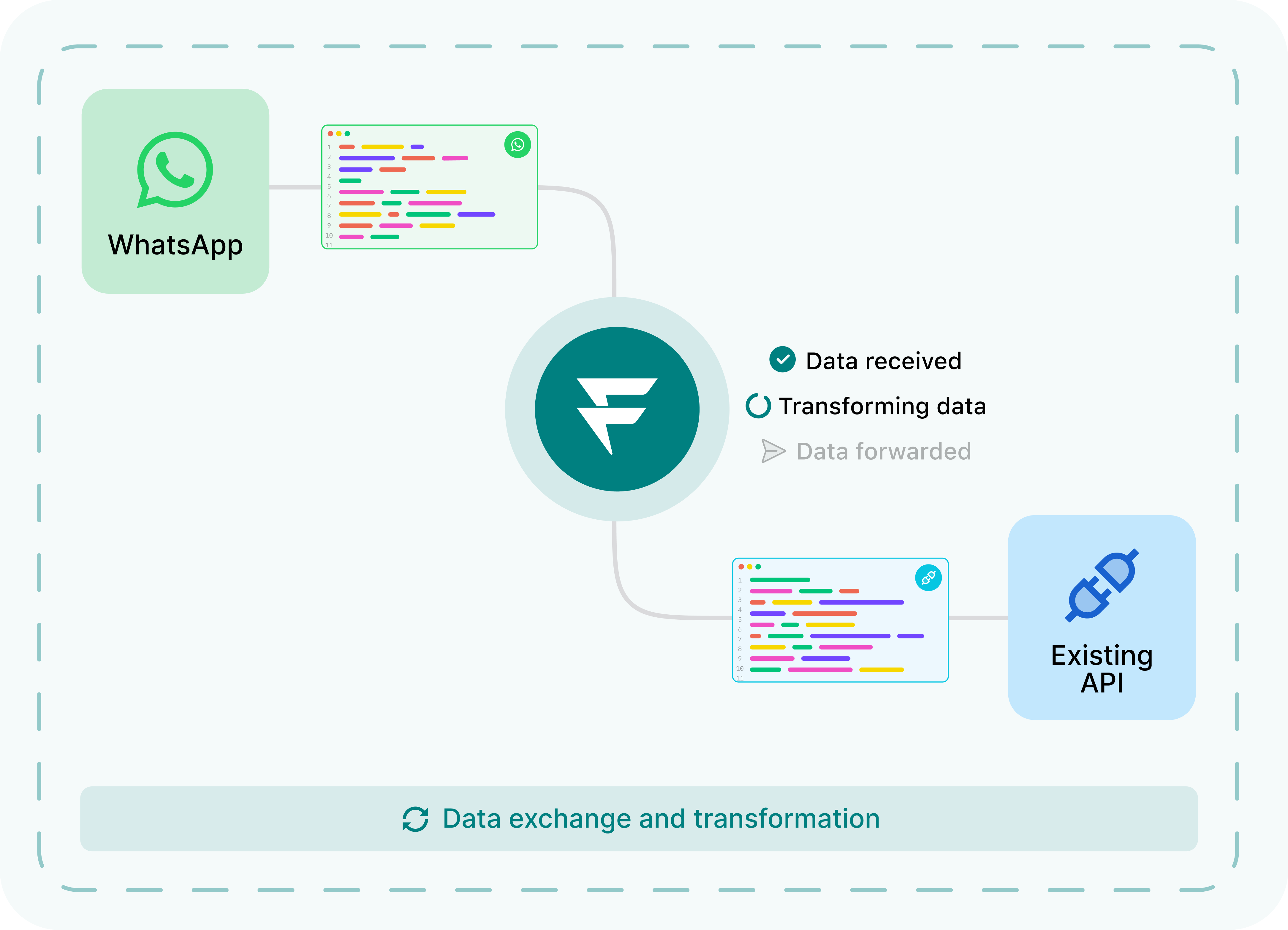

How Does Direct Meta Integration Work in Fyno?

Fyno maintains direct API integration with Meta's WhatsApp Business Platform while keeping billing separate:

What You Get:

Direct Meta API connectivity (same as CPaaS)

Template approval and compliance support

Enterprise SLAs and infrastructure

Without paying 12-20% markup on conversations

Billing Transparency:

Line 1: Meta invoice ₹4.3 Cr (50Mn conversations at ₹0.86)

Line 2: Fyno platform fee (usage-based, not volume-based)

Complete visibility: delivery cost vs technology cost

What Strategic Benefits Does INR Billing Provide in 2026?

Cost Transparency and Budget Control

Product-Level Cost Allocation: Traditional CPaaS bundled invoicing makes product-line allocation impossible.

With Separated Billing: Finance calculates true product profitability, including communication costs, enabling data-driven decisions on which products justify higher engagement spend.

When Should You Switch to Direct WhatsApp INR Billing?

Switch Immediately If:

Volume Threshold:

Sending >10M WhatsApp messages monthly

Annual communication spend >₹10 Cr

Planning 50%+ traffic growth in 2026

Financial Pressure:

Finance demanding product/LOB cost allocation for 2026 budgets

CFO scrutinizes communication spend line-by-line

Need to demonstrate 15-20% cost reduction for FY 2026-27

Timing Triggers:

Q4 FY 2025-26 budget planning (capture full-year 2026-27 savings)

CPaaS contract renewable within 6 months

Regulatory audit requiring delivery proof and cost documentation

Evaluate But Wait If:

Sending <5M messages monthly

Locked in CPaaS contracts with 12+ month penalties

Major tech transformation already underway

IT team overloaded with competing 2026 priorities

Begin planning:

Ask your CPaaS vendor or prospect for a Request cost breakdown.

Calculate savings using comparison tables, document contract terms, and build a business case for mid-2026 or FY 2026-27 implementation.

Key Takeaways

Cost Savings:

Direct INR billing eliminates 12-20% CPaaS markup

Enterprises save ₹1- 15 Cr annually (1-100Mn messages per month)

Billing Transparency:

CPaaS bundles delivery + platform fees into marked-up price

Orchestration separates Meta invoice from platform invoice

Enables product/LOB-level cost allocation for profitability analysis

Implementation:

Non-disruptive: works alongside existing infrastructure

Karnataka Gramin Bank and Lendingkart were deployed without replacing core systems

API-first approach preserves banking/LOS/CRM integrations

Strategic Value:

Budget predictability without markup volatility

RBI/IRDAI compliance with complete audit trails

Vendor independence for better rate negotiation

Future-ready for multi-channel orchestration

Comments

Your comment has been submitted