How BFSI as a sector wastes 60-70% on WhatsApp Business Charges

Understanding WhatsApp Business Pricing Dynamics

Understanding WhatsApp Business charges is critical for BFSI cost optimisation. Enterprises can achieve a 60-70% reduction in WhatsApp business charges through intelligent message classification, timing optimization, and engagement architecture, not vendor switching.

Most organizations overspend because 40-60% of messages are misclassified into wrong pricing categories or mistimed, missing free delivery windows. This comprehensive guide reveals the three-lever framework that transforms WhatsApp from a cost center to a strategic advantage. It also defines how you can use orchestration and routing technology platforms like Fyno to automate most of these tasks and measure them as well.

The Hidden Cost Multipliers in WhatsApp Communication

When Protium, a leading financial services platform, analyzed their communication costs, they discovered something startling: their WhatsApp expenses weren't high because of vendor pricing, they were high because of operational inefficiencies. By implementing intelligent workflow automation and message orchestration, they achieved 40% cost optimization across their entire communication infrastructure.

The revelation? Their WhatsApp costs weren't inflated by expensive vendors. They were inflated because messages were trapped in wrong pricing categories, mistimed, and sent inefficiently.

How WhatsApp Pricing Actually Works

Meta's WhatsApp Business Platform operates on a per-message pricing model with four distinct tiers, each with dramatically different costs:

Marketing: ₹0.86 per message (promotional offers, product updates, campaigns)

Utility: ₹0.115 per message (transactional updates, order confirmations, delivery notifications)

Authentication: ₹0.115 per message (OTPs, account verification, security codes)

Service: ₹0 (free within 24-hour customer-initiated window)

The cost difference is stark, a marketing message costs 7.5x more than a utility message. With the WhatsApp marketing price at ₹0.86 versus ₹0.115 for utility/authentication, organizations sending millions of messages monthly face catastrophic waste through misclassification.

The Mathematics of Misclassification

Illustrative example of how misclassification creates waste:

Transaction alerts flagged as Marketing due to promotional keywords (should be Utility)

Inquiry responses sent as Marketing

Loan payment reminders as Marketing

Quick math: Optimizing 50 million messages from average ₹0.115 to sending it wrongly under marketing at ₹0.86 per message is 44 cr worth of wastage annually.

What Determines WhatsApp Message Costs in 2026?

Per-Message Pricing Structure

Effective January 1, 2026, WhatsApp shifted to transparent per-message billing in India. Understanding the pricing tiers is critical forcost optimization as Meta is also about to launch direct INR billing in India:

Let us understand first the message category definitions:

Marketing Messages (₹0.86) includes:

Promotional broadcasts

Cross-sell/upsell campaigns

Product launches

Seasonal offers

Re-engagement campaigns

The WhatsApp marketing price increased 10% on January 1, 2026 (from ₹0.7846 to ₹0.86), making intelligent classification even more critical for BFSI organizations running high-volume campaigns.

Utility Messages (₹0.115) includes:

Order/transaction confirmations

Delivery status updates

Payment receipts

Appointment reminders

Account activity notifications

Authentication Messages (₹0.115) includes:

Login OTPs

Transaction verification codes

Password reset tokens

Multi-factor authentication

Account recovery codes

Service Messages (₹0) includes

Responses within 24-hour customer service window

Customer support replies

Query resolution

Account assistance

Volume Tier Pricing

Meta offers volume-based discounts for Utility and Authentication messages. As monthly volumes increase, per-message costs decrease:

0-25M messages: Base rate

25M-50M messages: ~6% discount

50M-100M messages: ~12% discount

100M-200M messages: ~18% discount

200M-300M messages: ~24% discount

300M+ messages ~ 30% discount

Marketing messages do not qualify for volume discounts, making classification accuracy even more critical for promotional campaigns.

WhatsApp INR Billing for India (2026)

In the starting of this year i.e. 2026, Meta plans to introduce direct WhatsApp INR billing, replacing USD-based invoicing. This change provides:

Transparent local currency pricing (no FX conversion surprises)

Predictable budget planning in rupees

Simplified reconciliation against Indian accounting systems and more

We did a detailed analysis of this as well and how to prepare for this change.

Organizations must ensure their WhatsApp Business Account (WABA) "Sold-To Country" is set to India to qualify for INR billing.

The Three-Lever Framework for Cost Optimization

Most BFSI organizations focus exclusively on Lever 1 (vendor pricing), missing 50-60% of potential savings. The complete framework recognizes three distinct levers:

Lever 1: Vendor Pricing (10-20% Impact)

Shopping for better rates, negotiating volume discounts, switching BSPs.

Reality: Vendor pricing differences rarely exceed 15%. All reputable BSPs charge near-identical rates because they're ultimately paying Meta.

Lever 2: Message Classification (30-40% Impact)

Ensuring every message lands in the correct pricing tier based on content, purpose, and customer journey stage.

The Game-Changer: This is where most organizations leak 30-40% of their budget through misclassification.

Lever 3: Timing + Engagement (20-30% Impact)

Intelligent timing to leverage free windows, message consolidation, and engagement-based channel selection.

Combined Potential: 60-70% total cost reduction when all three levers work together.

Why Message Classification Matters Most

Common Misclassification Patterns in Finance and BFSI sector

❌ Inconsistent Internal Tagging with different departments using varied criteria for tagging transactions or message types

❌ Transaction alerts with promotional keywords flagged as Marketing (should be Utility)

❌ Loan repayment reminders with offers as Marketing (legitimate, but optimize timing)

❌ Document submission confirmations as Utility (should leverage Service window)

❌ EMI due reminders as Marketing (should be Utility)

❌ E-signature requests as Marketing (should be Authentication/Utility)

❌ Loan approval notifications as Marketing (should be Utility)

Decision Tree for Optimal Classification

Step 1: Identify Intent

Security/verification → Authentication

Transaction/order update → Utility

Promotional/sales → Marketing

Customer-initiated support → Service

Step 2: Check Timing

Within 24-hour customer service window? → Use Service (free)

Outside window + transactional? → Utility

Outside window + promotional? → Marketing

Step 3: Validate Content

Contains offers, discounts, product promotions? → Marketing

Contains codes for verification? → Authentication

Contains order/transaction data? → Utility

Quick Win: Reclassification Audit

A comprehensive message audit typically reveals:

15-25% of messages can be reclassified to lower-cost tiers

8-12% of messages can be eliminated through deduplication

20-30% of messages can be retimed to leverage free windows

Immediate Savings: ₹3-5 crore annually for organizations sending 50M messages/month.

Timing Intelligence: Maximizing Free Windows

The 24-Hour Customer Service Window

When a customer messages your business, Meta opens a 24-hour free messaging window. All responses, including Utility templates, are completely free during this period.

Strategic Implications:

Batch Non-Urgent Updates: Hold non-critical notifications until customers engage

Prompt Customer Engagement: Use Quick Replies to trigger customer responses

Window Awareness: Track expiration and send reminder before window closes

Message Consolidation Strategies

Instead of:

Message 1 (9:00 AM): "Dear customer, your loan EMI of ₹15,000 is due on 15th Jan"

Message 2 (2:00 PM): "Dear customer, your insurance premium of ₹8,500 is due on 18th Jan"

Message 3 (5:00 PM): "Dear customer, your credit card bill of ₹24,500 is due on 20th Jan"

Cost: 3 × ₹0.86 = ₹2.58

Consolidate to:

Message 1 (9:30 AM): "Dear customer, upcoming payments:

• Loan EMI ₹15,000 - Jan 15

• Insurance ₹8,500 - Jan 18

• Credit Card ₹24,500 - Jan 20

Need help? Reply 'YES'"

Cost: ₹0.86 + Free follow-ups if customer responds = 67% savings

Urgency-Based Message Queuing

Implement three-tier urgency queues:

Immediate Queue: OTPs, fraud alerts, transaction confirmations (send instantly)

Time-Bound Queue: Payment reminders, appointment confirmations (within SLA, optimize timing)

Flexible Queue: Balance updates, offers, general notifications (wait for customer engagement)

Real-World Impact: A regional bank reduced costs by ₹96 lakh/year on 2 million customer queries by batching balance inquiry responses within customer service windows.

Engagement Architecture for Cost Efficiency

The Open Rate Reality

Marketing Messages: 40-60% open rate = 40-60% waste

Transactional Messages: 85-95% open rate

Strategic Shift: Don't send marketing messages to low-engagement customers via WhatsApp.

Progressive Channel Escalation

Decision Flow:

1. Email (free) → Wait 24 hours

2. No open? → SMS (₹0.15) → Wait 12 hours

3. No response? → WhatsApp (₹0.86) only for high-engagement customers

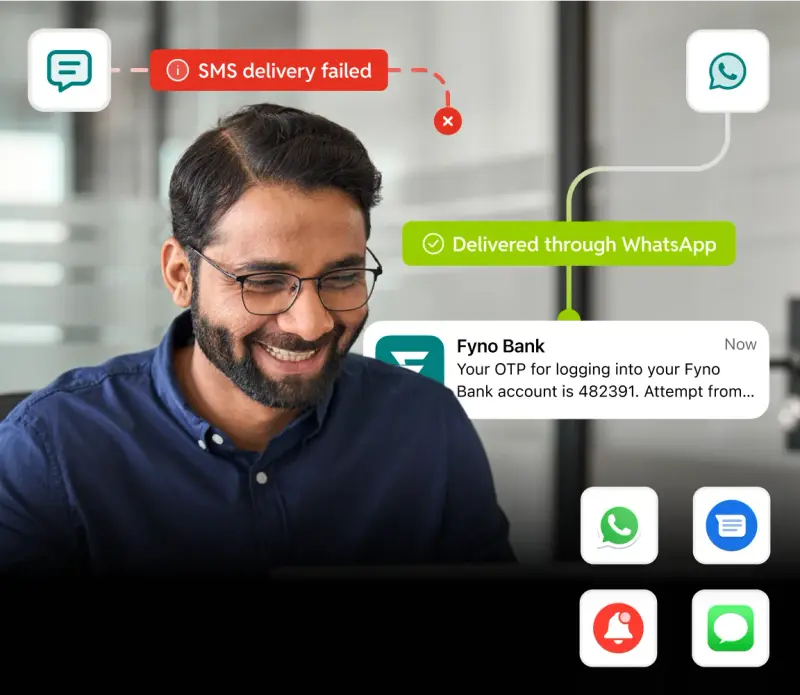

Progressive Channel Escalation with Fyno's Intelligent Routing

Fyno's Route Builder automates progressive channel escalation with real-time failover logic. Configure workflows that start with email (free), escalate to SMS (₹0.15) after 24 hours, then route to WhatsApp (₹0.86) only for high-engagement customers. The platform's automated failover engine switches vendors during downtimes, ensuring uninterrupted delivery while optimizing costs through intelligent channel selection based on engagement scoring and delivery tracking.

Engagement Scoring Model

Assign engagement scores based on 90-day behavior:

High (>70% WhatsApp open rate): Priority WhatsApp delivery

Medium (40-70%): Progressive escalation from email

Low (<40%): Suppress WhatsApp for 90 days, use SMS/email

BFSI Example: Removing 30% non-responders from credit card offer campaigns = ₹15.84 lakh annual savings on a 50,000-recipient monthly campaign.

Smart Tips for Cost Reduction

Based on proven strategies from Fyno's 6 Smart Ways to Cut WhatsApp Messaging Costs:

Combine Multiple Updates: Consolidate 3 separate messages into 1 digest

Use Quick Replies: Open free 24-hour windows with customer responses

Nudge Before Window Ends: Send reminder at hour 22 to reset free window

Monitor Template Categories: Regularly audit to prevent Marketing reclassification

Leverage 72-Hour Ad Windows: Click-to-WhatsApp ads provide 72 hours of free messaging

Smart Channel Routing: Use WhatsApp first, fallback to SMS only if unused

Technology Requirements for Intelligent Routing

Core Components

1. Classification Engine

Event context → Category mapping logic

Content analysis for template compliance

Anomaly detection for misclassification patterns

Real-time category validation

2. Intelligent Queue System

Priority queues (Immediate, Time-bound, Flexible)

24-hour window tracking per customer

Batch consolidation logic

SLA monitoring and alerts

3. Engagement Analytics

Open/click tracking by channel

Customer engagement scoring

Channel ROI calculation

Cost allocation by LOB/product/campaign

4. Routing Intelligence

Advanced routing capabilities include:

Intelligent Provider Selection: Lowest-cost provider based on real-time performance

Channel Fallback: Automatic SMS/email fallback when WhatsApp fails, preventing duplicates

Template Optimization: Character limit enforcement to avoid segmentation charges

Deduplication: Prevents multiple systems from sending identical alerts (UPI + core banking)

As organizations like Protium, Lendingkart, and Flexiloans discovered, these capabilities eliminate 15-20% of unnecessary traffic before messages even reach providers.

Orchestration Platform Advantages

A vendor-agnostic communication orchestration platform like Fyno provides:

Pre-Built BFSI Rules: Banking, insurance, and lending classification templates

Smart Queuing: Automatic priority-based routing and consolidation

Unified Multi-Channel View: SMS, WhatsApp, email, push in a single dashboard

Zero Conversation Markup: No hidden fees on top of Meta's rates

MMLite API Bonus: For organizations using Meta's Marketing Message Lite API, an additional 10% discount applies to all marketing messages—but only when routed through compatible platforms with proper implementation.

DPDP Compliance: The Two-Edged Sword

The New Reality: Compliance as Cost Driver

The Digital Personal Data Protection (DPDP) Act, 2023, and recent TRAI directives create unprecedented compliance requirements for WhatsApp communication:

Key DPDP Requirements Impacting WhatsApp Costs:

Explicit Consent Management

Must obtain verifiable consent before sending promotional messages

Consent records must be maintained for 7 years minimum

Withdrawal requests must be honored within 24 hours

Data Retention Limitations

Personal data in messages must be erased when purpose is served

Traffic data and logs must be retained for 1 year minimum (audit requirements)

Conflicting requirements create compliance complexity

Transparency Obligations

Clear notice about data processing before each campaign

Contact information for data protection officer must be accessible

Purpose and recipient information must be explicitly stated

TRAI Variable Tagging Rules (November 2025)

New TRAI directions mandate pre-tagging of variable fields in SMS templates. While not directly applicable to WhatsApp, the regulatory trend signals future requirements:

All dynamic fields must be pre-tagged (#number#, #url#, #alphanumeric#)

URLs must be whitelisted and validated

Non-compliant messages face automatic rejection

Strategic Implication: Organizations need intelligent platforms that adapt to evolving compliance requirements without manual intervention.

The Compliance-Cost Paradox

The Challenge:

You cannot send too many messages (DPDP restrictions)

You must get explicit consent for each category (operational overhead)

You must maintain detailed audit trails (storage costs)

Template rejections and rework create waste

The Solution: Intelligent Tech Platform

Manual compliance management is impossible at scale. Organizations need platforms built with:

Automated Consent Tracking: Preference management integrated with message routing

Audit Trail Automation: Complete logging with 7-year retention compliance

Category-Specific Consent: Granular consent management by message type

Withdrawal Processing: Instant suppression when customers opt out

Risk Without Proper Tools:

Message rejections: 5-15% of messages rejected = direct waste

Consent violations: ₹250 per violation under DPDP (₹1.25 crore fine risk on 50,000 violations)

Audit failures: Inability to prove compliance when regulators investigate

Brand damage: Customer complaints about unsolicited messages

Bottom Line: Compliance is no longer optional overhead, it's a mandatory cost driver that requires sophisticated technology solutions.

Success Metrics and Benchmarks

Cost KPIs

Primary Metrics:

Blended Cost Per Message: Target ₹0.35-0.45 (down from ₹0.65-0.75)

Waste Rate: <15% of messages in suboptimal categories

Classification Accuracy: >95% of messages in correct tier

Window Utilization: >60% of eligible messages sent in free windows

Benchmark Trajectory:

Month 0 (Before): ₹8.0 Cr annual spend (50M messages @ ₹0.64 avg)

Month 3 (Phase 2): ₹5.6 Cr (30% reduction through classification)

Month 6 (Phase 3): ₹3.0 Cr (63% reduction, timing optimization added)

Month 12 (Optimized): ₹2.5 Cr (69% reduction, full engagement architecture)

Balance Metrics: Don't Sacrifice CX

While optimizing costs, maintain:

Delivery Rate: >93% (consistent with pre-optimization)

Customer Satisfaction (CSAT): >4.2/5.0

Response Time: <30 seconds for automated responses

Engagement Rate: Stable or improving (indicates better targeting)

Critical Rule: Cost optimization should not reduce customer experience quality. The goal is to eliminate waste, not valuable communication.

ROI Calculation Framework

Annual Savings = (Old Avg Cost - New Avg Cost) × Annual Volume

Implementation Cost = Platform fees + Integration + Training

Payback Period = Implementation Cost ÷ Monthly Savings

ROI = (Annual Savings - Implementation Cost) ÷ Implementation Cost × 100

Typical BFSI ROI:

Initial Investment: ₹15-25 lakhs (platform + implementation)

Monthly Savings: ₹40-60 lakhs (for 50M message volume)

Payback Period: 2-4 months

3-Year ROI: 2000-3000%

Summary: Key Takeaways

The Big Reveal: WhatsApp costs aren't high because of vendor pricing; they're high because messages are classified wrong, timed poorly, and sent to disengaged audiences.

Three-Lever Framework Delivers 60-70% Savings:

Message Classification (30-40% impact): Ensure every message lands in the correct pricing tier

Timing Intelligence (20-30% impact): Leverage free windows, consolidate messages, implement smart queuing

Engagement Architecture (10-20% impact): Progressive escalation, engagement scoring, channel optimization

Critical Success Factors:

✅ Conduct comprehensive audit to identify misclassification patterns

✅ Implement classification engine with BFSI-specific rules

✅ Deploy intelligent queuing for timing optimization

✅ Build engagement scoring for channel selection

✅ Use vendor-agnostic orchestration platform (avoid BSP lock-in)

✅ Maintain DPDP compliance with automated consent management

✅ Monitor metrics continuously: cost per message, waste rate, delivery rate, CSAT

Technology Makes It Possible

Manual management is impossible at 50M+ messages/month. Platforms like Fyno provide:

Pre-built classification rules for banking, insurance, and lending

Intelligent routing with automatic failover

24-hour window tracking and optimization

Engagement scoring and channel selection

Zero markup on Meta's conversation costs

Complete DPDP compliance automation

Compliance Is Non-Negotiable

With DPDP Act enforcement and evolving TRAI directives, intelligent technology isn't just about cost savings, it's about regulatory survival. Organizations without proper consent management, audit trails, and compliance automation face:

Template rejection waste (5-15%)

Regulatory fines (₹250 per violation)

Audit failures and brand damage

The Path Forward

Mastering WhatsApp Business pricing requires moving beyond vendor negotiations to intelligent message architecture.

Bottom Line: The organizations that master WhatsApp pricing dynamics in 2026 will transform communication from a cost center bleeding ₹8 crore to a strategic advantage costing ₹2.5 crore for the same volume, same customer experience, 69% less spend.

Ready to optimize your WhatsApp costs? Schedule a demo to see how intelligent orchestration delivers measurable savings in 90 days.

Comments

Your comment has been submitted