Fyno vs Traditional CPaaS for BFSI Communication Management

CPaaS platforms built for reselling message volumes charge a 12-20% markup while locking you into vendor-specific APIs and fragmented notification systems. Fyno operates as a compliance-first orchestration layer that manages your existing SMS aggregators and WhatsApp BSPs without a markup, cutting costs up to 40% through intelligent routing.

Banks keep negotiated provider contracts, add vendor flexibility (switch BSPs in 48 hours), and deploy in 4-8 weeks without replacing infrastructure. SOC 2-certified platform delivers centralized template governance (benefit of moving from 10 days to 36 hours approval), automatic RBI/TRAI/DPDP compliance, and real-time vendor performance monitoring, protecting against overbilling.

Karnataka Gramin Bank, Lendingkart, and Protium achieved cost reduction, compliance automation, and 100% deliverability through orchestration rather than direct CPaaS integration.

CPaaS Business Model: Built to Maximize Message Volume

Traditional CPaaS platforms exist primarily to resell SMS, WhatsApp, and email volumes for marketing alerts.

Firstly, their revenue model creates fundamental misalignment with enterprise BFSI needs:

BFSI needs a guarantee on deliverability

CPaaS needs more messages at a higher cost to make more revenue.

Outcome: Deliverability takes a back seat to volume maximization in CPaaS features and capabilities.

Secondly, there’s the Incentive Problem:

CPaaS providers mark up delivery costs 12-20% and bundle everything into a single invoice, obscuring true costs.

Success metrics prioritize message volume growth, not delivery efficiency or cost optimization.

Outcome: When your bank sends 50M messages monthly, generating ₹10 Cr in marked-up revenue, the CPaaS provider has zero incentive to help you reduce waste or optimize routing.

Thirdly, the Integration Burden:

Managing these platforms requires extensive development effort, including notification workflow management, implementing complex integrations, and making vendor-specific optimizations.

Each new channel adds a separate API requiring code changes.

Outcome: Engineering teams, including DevOps, spend 60-80 hours monthly maintaining and detailed monitoring of fragmented notification systems instead of building core banking features.

Fyno flips this model.

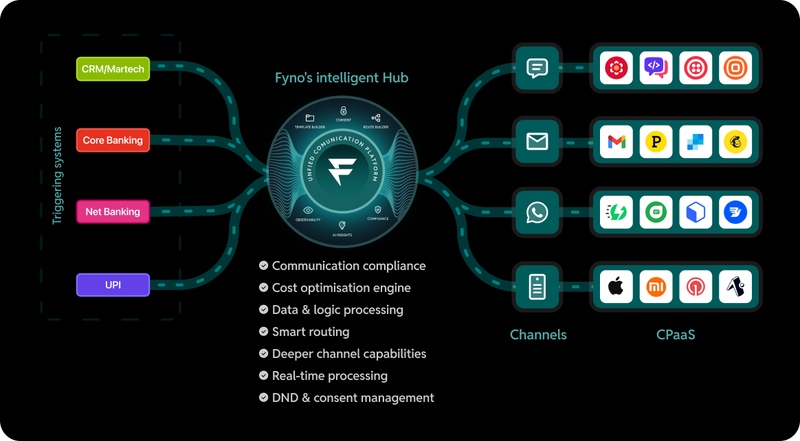

As a compliance-first, vendor-neutral BFSI-grade orchestration engine,

Fyno's revenue comes from platform technology, not message markup.

The success metric becomes delivery efficiency and cost optimization.

You can build consent-aware workflows and smart routing using our no code builder

Optimize messaging costs, and get real-time analytics on channel and vendor performance.

Integrate with 100s of CPaaS, BSPs and Telcos

All this while adhering to TRAI, DPDP, and RBI compliance guidelines.

It naturally aligns with BFSI goals to reduce communication waste while improving reliability of delivery, governance, compliance and cost-savings.

Why Traditional CPaaS Breaks at BFSI Scale

Separate APIs for Every Channel Increase Code Complexity

CPaaS platforms require separate API integration for SMS, WhatsApp, email, push notifications. Each channel has different authentication, request structure, webhook format, and error codes. Adding WhatsApp to SMS-only infrastructure means new API implementation, separate webhook handlers, different retry logic.

The Maintenance Burden: Credit card onboarding flow at a medium sized NBFC sends 12 notifications across channels. 4 different API integrations with different error handling, timeout configurations, and delivery tracking. The engineering team maintains 4 separate codebases for a single customer journey. Adding a new channel requires 3-4 week integration sprint with QA cycles and deployment coordination across teams.

Fyno Solution: One unified API for all communication channels. Banking applications call a single endpoint. Fyno handles channel-specific transformations, authentication, and webhook management. Adding RCS or voice requires zero application code changes. Teams save 60-80 engineering hours monthly previously spent on communication infrastructure maintenance.

No Native Smart Routing or Failover Logic

Traditional CPaaS excels at single-channel delivery: send this SMS, deliver that WhatsApp message. Cross-channel intelligence like "send OTP via WhatsApp, if undelivered in 30 seconds fallback to SMS" requires custom engineering in each calling application.

The Reliability Gap: A Tier1 BFSI player identified 8% of OTP requests failed due to WhatsApp template rejections. No automatic channel switching. Customers waited for manual SMS fallback. The engineering team spent weeks building custom failover logic across 15 different microservices.

Fyno Solution: Smart channel switching, automatic failover, and dynamic routing available from day one. OTP sent via WhatsApp at T+0. Delivery report not received by T+30s? Automatic retry via SMS Provider A. Still undelivered by T+45s? Failover to SMS Provider B. Reduced BFSI's OTP delivery latency from 42 seconds to 8 seconds with zero custom development. Achieve up to 100% deliverability for every message

Template Management Scattered, Manual Approval Cycles

Banks maintain 150-300 DLT SMS templates across 3-5 aggregators, 80-150 WhatsApp templates in Meta Business Manager. CPaaS platforms force handling channel-wise templates in silos with separate processes for WhatsApp and SMS approvals. Each portal has different workflows, versioning, expiration tracking.

The Approval Nightmare: Marketing creates loan disbursement notification. Manual workflow requires drafting, legal review, DLT submission (5-7 days), WhatsApp submission (2-3 days), configuring in code, tracking expiration in spreadsheets.

Total cycle: 8-12 days.

An agile growing NBFC spent 40% of martech capacity managing this chaos because they prioritised customer delight.

Fyno Solution: Centralized template editor with maker-checker flows and built-in auto-approval for DLT/Meta templates. Content creators draft, compliance approves with one click, templates automatically propagate to DLT and WhatsApp with complete audit trail. Protium reduced the approval cycle from 10 days to 36 hours with full version history satisfying RBI, DPDP, and TRAI audits.

Basic Delivery Stats Without Vendor Performance Insights

CPaaS platforms provide basic delivery stats per campaign: messages sent, delivered, failed. No visibility into which provider performed poorly, what caused failures, or whether you are being overbilled.

The Attribution Gap: SMS provider bills ₹18.5L for November. Finance demands breakdown by product line, message type, domestic vs international. The CPaaS dashboard shows only aggregate totals. IT cannot provide attribution because per-message costs are hidden in proprietary rate cards. Large banks spend 40-80 hours monthly building custom reconciliation systems with inaccurate results.

Fyno Solution: Real-time analytics on delivery, cost, and vendor performance. Track each notification from dispatch to delivery. Unified dashboard shows delivery rates, engagement patterns, vendor-specific performance metrics. Detailed logs enable reconciling numbers with service providers and catching overbilling.

Manual Scaling Tickets Create Throttling Risks

High-volume bursts during festival campaigns or product launches require advance notice to CPaaS providers. Manual tickets requesting capacity increases. Risk of throttling errors if volume exceeds provisioned limits. No automatic queue management.

The Scaling Problem: Bank launches credit card campaign expecting 10M messages over weekend. Submits ticket to CPaaS provider. Provider provisions capacity. Actual volume hits 14M. The system throttles messages causing delivery delays and customer complaints. No built-in intelligence to handle bursts.

Fyno Solution: Auto-scales with smart queuing and throttling for peak loads. Platform designed for failure scenarios with intelligent queue management preventing throttling errors. No manual tickets required. The system automatically handles volume bursts while maintaining delivery SLAs.

Fyno's Orchestration Model: Compliance-First Delivery Control

Unified API for All Channels With 100+ Provider Integrations

Fyno unifies every channel and provider behind a single API. Banking applications call one endpoint regardless of whether message routes to SMS, WhatsApp, email, RCS, voice, or push notification. The platform handles all channel-specific complexity, replacing fragmented notification systems with centralized orchestration.

One-Click Provider Connectivity: Fyno maintains pre-built integrations with 100+ providers including all major Indian SMS aggregators (Kaleyra, Route Mobile, Tanla), WhatsApp BSPs (Gupshup, WATI, Sinch, Infobip), and global platforms. Add credentials, start routing in 15 minutes. No custom integration development required.

Smart Channel Switching and Automatic Failover Built-In

Fyno ships with intelligent orchestration eliminating need for custom failover logic. The platform continuously monitors provider health metrics: P90/P99 latency per provider per region, delivery success rates trending over 15-minute windows, error code distributions indicating systemic issues.

Automatic Provider Failover: When Provider A's latency degrades from 5s to 45s, routing engine automatically shifts traffic to Provider B until health recovers. Operations receive alert but no manual intervention required.

Time-Based Channel Failover: Priority 1 OTP sent via WhatsApp. Not delivered within 20 seconds? Automatic SMS retry. Still pending at 45 seconds? Route through alternate SMS provider. Ensures sub-60-second delivery despite individual channel failures.

Traditional CPaaS would require the engineering team manually failover traffic with code changes. Fyno's automatic detection and routing shift happened within 90 seconds maintaining SLAs without operational intervention.

Centralized Template Editor With Maker-Checker Flows

Unified template management consolidates DLT and WhatsApp templates into a single interface with enterprise-grade governance. Role-based access separates creation from activation. Junior marketers draft but cannot deploy. Compliance officers approve but cannot create.

Complete Template Lifecycle: Draft (content creators compose) → Compliance Review (built-in rules flag risky language) → Approval (designated approvers with audit trail) → Provider Sync (automatic DLT and Meta submission) → Activation (live only after provider approval) → Monitoring (usage tracking, quality scores, expiration alerts).

Version Control and Rollback: Complete template history showing who changed what when. Rollback capability when new versions underperform. A/B testing supports validating content effectiveness before full deployment.

Real-Time Analytics on Delivery, Cost, and Vendor Performance

Fyno pulls delivery logs from every connected communication vendor into a unified dashboard. Real-time metrics on each vendor's delivery speed and success rate. Insights enable working with best vendors for every channel maintaining maximum deliverability.

Overbilling Protection: Platform captures exact number of messages each vendor delivered. Finance team cross-verifies against vendor invoices challenging overcharges. Banks discover discrepancies between billed volume and actual delivered volume, recovering tens of lakhs in overbilling.

Granular Cost Attribution: Every message tagged with product line, business unit, campaign while sending. Dashboard shows Credit Cards ₹18.3L, Personal Loans ₹12.7L, Savings Accounts ₹8.2L. Export for financial system integration. Zero manual reconciliation required.

Auto-Scales With Smart Queuing for Peak Loads

The platform is designed to integrate closely with the organization's internal technology infrastructure ensuring low latency (P90 < 50ms, P99 ~79ms), high throughput, and real-time communication processing. Automatic scaling handles volume bursts without manual provisioning.

Intelligent Queue Management: Smart queuing prioritizes OTPs and transactional alerts over bulk promotional messages. Rate limiting prevents spray attacks. Throttling respects vendor quotas. Retry and deduplication logic ensures exactly-once delivery without customer annoyance.

Business Model Comparison: Volume vs Efficiency

CPaaS Revenue Model Aligns With Higher Costs

CPaaS Business Model:

Owns Meta relationship, resells API access

Revenue from marking up conversations 12-20%

A single bundled invoice obscures true costs.

Success metric: maximize message volume.

Incentive Misalignment: Whenfestival campaigns drive traffic from 50M to 80M messages (60% growth), CPaaS revenue increases from marked-up volume.

BSP benefits from higher spend.

No incentive to optimize routing, reduce waste, or suggest cost-effective channels.

Volume Commitments:

Contracts require quarterly minimums

Unused credits expire

Growth beyond commitment triggers penalty rates

Under-projection wastes money on unused credits

Over-projection pays premium on overages

No flexibility matching actual usage patterns.

Fyno Revenue Model Aligns With Cost Reduction

Orchestration Business Model:

Facilitates direct Telecom, Meta and BSP relationship and billing

Revenue from platform usage (API calls, features)

Separated billing: Routing entity invoice + technology platform fee clearly distinguishable.

Success metric: optimize delivery efficiency and cost.

Incentive Alignment:

Fyno generates revenue from orchestration capabilities (intelligent routing, compliance automation, unified analytics) rather than reselling conversations. More efficient delivery with fewer wasted messages equals more value for banks and a sustainable platform business model. Platform intelligence saves budget wastage, almost paying for itself. You end up saving more in communication spends with Fyno than with CPaaS or BSP; while being compliant, and better communication deliverability guarantee.

Zero Markup Promise:

Bank pays Provider A's negotiated ₹0.18/SMS rate directly to Provider A per existing contract. Fyno never touches delivery invoicing. Complete transparency: platform invoice shows technology fees, provider invoice shows delivery costs.

Real Numbers: 40% Cost Optimization Achievable

Channel Selection Optimization: Route low-engagement promotions via SMS (₹0.15) instead of WhatsApp (₹0.86) saving 82% per message. High-engagement campaigns justify WhatsApp premium pricing with superior results.

Provider Performance Matching: Match provider to message requirements. OTPs via premium provider (₹0.22, 8-second delivery). Bulk notifications via economy provider (₹0.15, 3-minute delivery). Saves 8-14% by avoiding one-size-fits-all routing.

Waste Elimination: Deduplication prevents identical transaction alerts via multiple systems. Suppression stops repeatedly attempting invalid numbers. Template optimization reduces unnecessary segmentation. Saves 5-12% by eliminating zero-value sends.

Composite Savings: Conservative estimate with intelligent orchestration achieves 15-20% savings. Aggressive optimization with no-code workflow builder and smart channel selection reaches 40% cost reduction demonstrated in customer deployments.

Karnataka Gramin Bank POC: Pre-Fyno ₹42.3L monthly spend. Post-Fyno pilot: ₹11.8L vs ₹12.7L projected = 7% immediate savings. Full deployment projection: ₹35.1L monthly (17% reduction), ₹86.4L annual savings. Platform fees ₹15L. Net savings: ₹71.4L annually.

Key Capabilities CPaaS Cannot Provide

Vendor Performance Monitoring and Overbilling Protection

Fyno tracks delivery logs from every connected provider with real-time visibility into each vendor's delivery speed, success rate, error distributions, and latency patterns. Analytics enable data-driven decisions on provider selection and contract negotiations.

Protection Against Overcharges: Platform captures exact delivered message count per vendor. Your finance team receives numbers for cross-verification against vendor invoices. Banks routinely discover 3-8% discrepancies between billed volume and actual deliveries, challenging overcharges backed by evidence.

True Multi-Vendor Real-Time Routing

CPaaS platforms provide single provider or static fallback rules. Fyno enables dynamic routing across multiple vendors based on real-time performance, cost optimization, geographic coverage, and message priority. Vendor flexibility without vendor lock-in.

Add Providers in 15 Minutes:

Negotiated better rate with new aggregator? Add credentials to Fyno, start A/B testing immediately.

Good performance? Gradually shift traffic percentage.

Poor results? Route back to primary. No application code changes required.

SOC 2-Certified Security With Data Masking Built-In

CPaaS platforms offer limited enterprise-grade controls with responsibility left to the bank. Fyno provides SOC 2-certified infrastructure with data masking, hashing, and encryption built-in. Sensitive fields (mobile numbers, email addresses) automatically masked in UI and reports.

Compliance-Ready Architecture: Role-based access control with granular permissions. Complete audit trails for regulatory review. Data residency options (on-premises, dedicated cloud, public SaaS with Indian data center guarantee) meeting banking security requirements.

Feature Agility: Add Channels Without Redeployment

CPaaS platforms require waiting months for new features on the vendor roadmap. Want WhatsApp native flows? Must wait for a CPaaS provider to build. Fyno's channel-agnostic architecture enables instant feature additions.

One-Click Channel Additions:

Add RCS, voice, or emerging channels instantly.

No code deployment required.

Marketing team updates preferences via drag-and-drop interface.

Changes live within minutes.

Feature velocity matching business needs instead of vendor schedules.

No-Code Post-Deployment Changes

Once deployed, business teams modify communication flows without touching codebase.

Marketing updates templates,

Compliance approves workflows,

Operations adjusts routing rules.

Engineering team freed from communication infrastructure maintenance.

Implementation Reality: 4-8 Weeks, Zero Engineering Dependency

Week 1-2: POC Without Production Data:

Fyno provides a test account with simulated infrastructure.

Developers validate API integration against sandbox.

Upload sanitized templates, test governance workflows.

Zero risk requiring production system access.

Week 3-4:

Integration Using Existing Providers: Application team develops Fyno API integration (typically 3-5 engineering days).

Configure connections reusing existing CPaaS providers.

Upload templates.

Setup monitoring and alerting.

Week 5-6:

Testing Proves Capabilities: Functional testing with test messages across channels.

Load testing validates throughput.

Failover testing demonstrates routing intelligence.

Security and compliance validation satisfies audit requirements.

Week 7-8:

Controlled Production Rollout: Deploy with 5% traffic monitoring key metrics.

Gradually increase to 20%, then 50%, then 100%.

Maintain easy rollback throughout.

Existing CPaaS remains backup during transition ensuring zero service disruption.

Real Timeline: Mid-size NBFC (10M monthly messages) completed full deployment in 6 weeks. Large private bank (80M monthly messages, 30+ applications) required 14 weeks accounting for coordination complexity. Both achieved cost reduction, compliance automation, and 100% deliverability through orchestration.

Comments

Your comment has been submitted